Deciding how to get a professional coffee machine into your business is a huge step. For many businesses, the answer is leasing. This guide explains how commercial coffee machine leasing works, making it a smart, affordable way to serve fantastic coffee without the large upfront cost.

Leasing is like a long-term rental. You get to use a top-of-the-range machine for a fixed monthly fee. This gives you all the benefits of incredible coffee without the hefty initial payment or the headache of surprise repair bills.

What Is Commercial Coffee Machine Leasing?

Think of it like leasing a company car. Instead of paying thousands of pounds to buy it outright, you pay a manageable monthly amount to use it over a set period, typically three to five years. This approach opens the door to premium equipment for businesses of all sizes and is a very popular choice.

Leasing is perfect for a new café needing to protect its start-up capital, but it’s just as useful for an established office looking for simple, predictable expenses. Better yet, the fixed monthly payments often include installation, regular servicing, and technical support, so you’re never caught out by an unexpected bill.

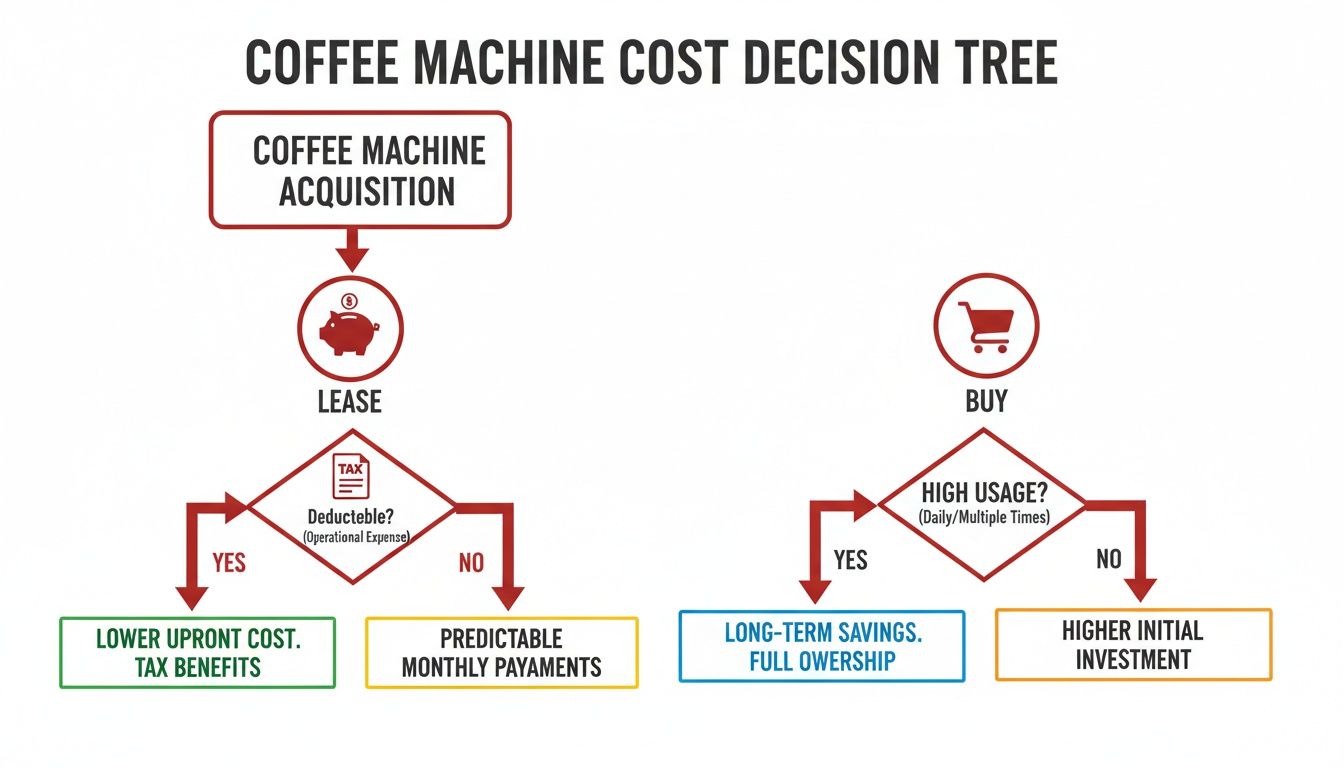

Leasing vs. Buying: A Quick Comparison

Each option has its place, and the right choice depends on your business's cash flow, long-term plans, and how you prefer to manage assets. Seeing them side-by-side helps clarify which route is best for you.

| Consideration | Leasing | Buying |

|---|---|---|

| Upfront Cost | Low, usually just the first month's payment. | High, full purchase price paid upfront. |

| Monthly Payments | Fixed, predictable monthly fees. | None, but you might have loan repayments. |

| Maintenance & Repairs | Often included in the lease agreement. | Your responsibility; can be costly. |

| Upgrading Equipment | Easy to upgrade at the end of the term. | Requires selling the old machine and buying a new one. |

| Ownership | You don't own the machine. | You own the machine outright as a business asset. |

| Tax Benefits | Monthly payments are usually 100% tax-deductible. | Can claim capital allowances on the asset's value. |

Ultimately, leasing is about preserving cash and gaining flexibility, while buying is a long-term investment. For many, the simplicity and peace of mind that comes with a leasing package is the deciding factor.

Who Benefits From Leasing A Coffee Machine?

Leasing is a fantastic option for a wide range of businesses, not just your typical high-street coffee shop. It’s a smart move for anyone who wants to serve fantastic coffee without sinking precious cash into an asset that loses value over time.

Does your business fit one of these profiles?

- New Cafés & Start-ups: Cash flow is king when you're starting out. Leasing gets you the best equipment from day one without wiping out your budget.

- Offices & Corporate Spaces: Great coffee is a huge workplace perk. Leasing provides a simple, all-in-one solution with predictable costs that fit neatly into the operational budget.

- Hotels & Restaurants: Guest expectations are high. Leasing ensures you always have a reliable, modern machine to deliver a premium experience, with support included to minimise downtime.

- Growing Businesses: As your business expands, so do your needs. Leasing gives you the freedom to upgrade your equipment at the end of the term to keep pace with your growth.

Have a look through our extensive range of commercial coffee machines to see the calibre of models available for lease.

What is the True Cost of a Commercial Coffee Machine Lease?

When you’re looking at a high-quality coffee machine, it’s easy to focus on the sticker price or the monthly payment. But that's only part of the picture. To really understand the finances, you need to look at the total cost over the machine's lifetime.

Buying a machine outright means a big chunk of cash leaves your bank account immediately. That’s capital that could have been spent on marketing, staff, or stock. On top of that, you’re also responsible for all ongoing costs, which can pop up unexpectedly and add up fast.

In contrast, commercial coffee machine leasing turns that unpredictable expense into a fixed, manageable monthly payment. That kind of predictability is brilliant for budgeting, letting you forecast your outgoings with confidence.

The Hidden Costs of Buying a Machine

Purchasing a commercial coffee machine might feel like a solid investment, but the costs don't stop there. To make a fair comparison with leasing, you must factor in the hidden expenses that arise over the machine's life.

Here are the real-world costs to budget for when you buy:

- Installation and Setup: A professional-grade machine isn't a DIY job. You’ll need to pay an expert to install it, connect it to the water mains, and calibrate it perfectly.

- Ongoing Maintenance: Just like a car, your coffee machine needs regular servicing. Annual services can easily cost hundreds of pounds, and that’s a cost you have to cover.

- Emergency Repairs: When a critical part fails outside the warranty period, you face an expensive emergency call-out fee, plus parts and labour. All the while, you're losing sales.

- Depreciation: A coffee machine is a depreciating asset. From the moment it's installed, its value starts to drop.

How Leasing Covers More Than Just the Machine

One of the biggest advantages of a commercial coffee machine leasing agreement is that it often wraps all those unpredictable costs into one simple, flat payment. It's an all-inclusive approach that gives you incredible peace of mind.

A great lease package isn't just about getting a machine; it's about securing a comprehensive service that protects your cash flow and eliminates operational headaches. With a lease from ADS Coffee Supplies, you're getting a full-service package that typically includes:

- Professional Installation: Our expert engineers handle the entire setup.

- Scheduled Servicing: We include regular maintenance in the plan to keep your machine in peak condition.

- Priority Technical Support: If something goes wrong, our team is on hand to get you back up and running fast.

This turns a volatile capital expense into a stable operating cost, which makes financial planning much simpler. Our guide on leasing vs. buying a coffee machine for your business breaks this down in even more detail.

The Big Tax Advantage of Leasing

For UK businesses, the financial case for leasing gets even better when you consider tax. Lease payments are classed as an operating expense, which means they are typically 100% tax-deductible. In plain language, this means you can offset the entire cost of your monthly payments against your taxable profits, directly reducing your corporation tax bill.

When you buy a machine, you can only claim capital allowances on its depreciating value—a much slower process. It’s no surprise that so many UK businesses opt for this financially savvy route. Leasing helps British cafés, offices and hotels stay competitive and perfectly equipped.

How to Navigate Your Leasing Agreement

Signing a lease for a coffee machine might seem daunting, but the agreement is more straightforward than you might think. A good contract is designed to protect both you and the provider, setting out a clear and successful partnership.

At its heart, a lease is a long-term rental agreement. You get full use of a high-value piece of equipment for a fixed, manageable monthly fee. This is the core idea behind commercial coffee machine leasing.

Finance Leases vs Operating Leases

You will likely come across two main types of lease: finance leases and operating leases. They sound similar but function very differently.

- A finance lease is like a hire-purchase agreement. You essentially pay off the machine's value over the term and are responsible for maintenance. At the end, you usually have the option to make a final payment to own it.

- An operating lease is much closer to a straightforward rental. The leasing company retains ownership, so the machine doesn't go on your balance sheet. Maintenance is often included, and at the end of the term, you can hand it back, upgrade, or extend the agreement. For most businesses, this is the more flexible, hassle-free option.

Key Terms to Look For

Every lease agreement has specific terms, so it's important to read the small print and ask questions until every point is clear.

Here are the key things to pay attention to:

- Lease Duration: Most leases run for three or five years. A shorter term lets you upgrade sooner, while a longer one will usually mean a lower monthly payment.

- End-of-Term Options: The agreement should clearly state what happens when the contract finishes. Can you buy the machine, upgrade, or return it?

- Service and Maintenance Clause: Check exactly what level of servicing is included, the guaranteed response time for call-outs, and whether you'll face extra charges for parts or labour.

- Insurance and Liabilities: The contract will state who is responsible for insuring the machine against damage or theft.

Crucial Questions to Ask Your Provider

Before you sign, you need to feel completely confident the agreement is right for you. A reputable provider will happily answer your questions clearly and honestly.

| Category | Question to Ask |

|---|---|

| Costs & Payments | What is the exact monthly payment, including VAT? Are there any upfront fees or a final payment? |

| Service & Maintenance | What does the service package include? What is your guaranteed response time for an engineer call-out? |

| End of Lease | What are all my options when the lease term ends? Can I upgrade early if my needs change? |

| Insurance | What are my insurance obligations? What happens if the machine is accidentally damaged or stolen? |

| Training & Support | Is on-site staff training included with the installation? Who do I call for day-to-day support? |

| Supplies | Am I tied into buying coffee beans or other supplies from you for the duration of the lease? |

| Contract Flexibility | What happens if my business moves premises? Can the terms be adjusted if our needs change significantly? |

Asking these questions upfront is the key to entering a commercial coffee machine leasing agreement that truly benefits your business. For more detail, read our guide on how coffee machine lease rentals work.

Matching the Right Machine to Your Business Needs

When thinking about leasing a coffee machine, it’s a strategic decision that needs to fit your business perfectly. The high-powered espresso machine a bustling café relies on would be overkill for a small office. Likewise, a simple pod machine would grind to a halt in a busy restaurant.

The secret to a successful commercial coffee machine leasing plan is finding the right fit. Taking a moment to figure out exactly what you need will ensure your lease delivers real value from day one.

How Many Cups Will You Make a Day?

First, you need a handle on your numbers. How many coffees do you expect to serve each day? This single question will narrow down your choices more than anything else.

- Low Volume (Under 50 cups/day): Perfect for small offices or reception areas. A compact bean-to-cup or quality pod machine gives you great coffee without taking up too much space.

- Medium Volume (50-150 cups/day): This is the sweet spot for larger offices, small cafés, or hotel breakfast services. A robust, automatic bean-to-cup machine can handle more pressure and offer a variety of drinks.

- High Volume (150+ cups/day): For a busy coffee shop, large restaurant, or canteen, a traditional multi-group espresso machine is built for speed, power, and non-stop performance.

It's always smart to lease a machine with a little more capacity than you think you need today—it gives you valuable room to grow. For a more detailed look, see our guide on how to choose a commercial coffee machine by footfall and menu.

Who's Making the Coffee?

Next, think about the people who will be using the machine. The level of automation you need depends on your team's skills and the complexity of your coffee menu.

A traditional espresso machine is brilliant in the hands of a trained barista, giving them total control. A fully automatic bean-to-cup machine, however, lets anyone make a great cappuccino at the push of a button—ideal for self-service areas or offices where no one is a coffee expert. The best machine is one that empowers your team, not overwhelms them.

The Importance of Water Filtration

One component that is easy to overlook but critical to your machine's health and your coffee's taste is water filtration. Much of the UK has hard water, and limescale is the number one killer of commercial coffee machines. It clogs pipes, damages heating elements, and makes coffee taste flat.

A professional water filter isn't an optional add-on; it's a non-negotiable part of any commercial coffee machine leasing package. It protects the machine from expensive damage and ensures every cup tastes clean and delicious. That’s why at ADS Coffee Supplies, we always include a water filtration solution with our leases.

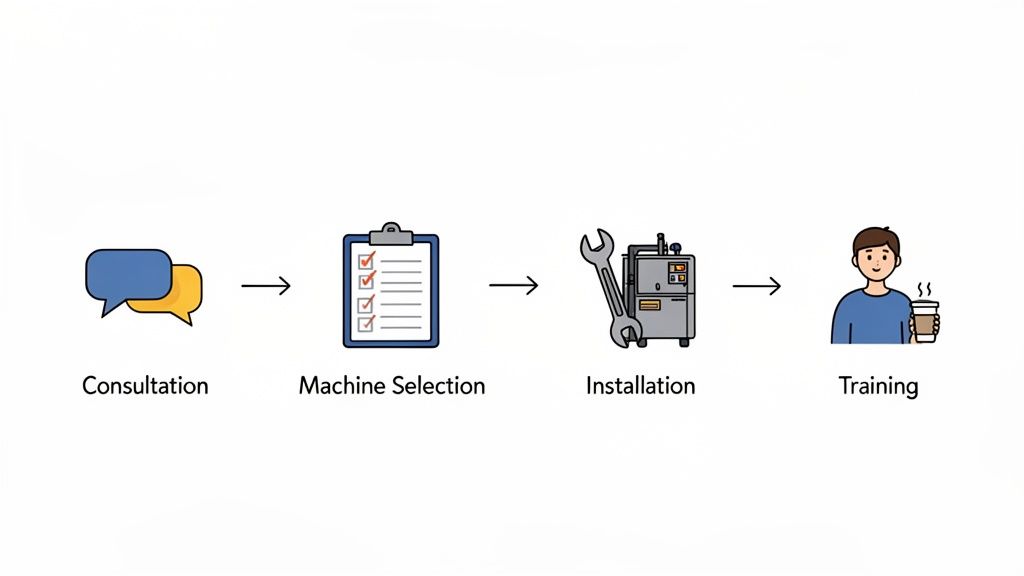

Our Simple Step-by-Step Leasing Process

Getting started with commercial coffee machine leasing shouldn't be complicated. We’ve designed our process to be as smooth and straightforward as possible. We guide you through every stage, from our first chat to long after your machine is installed.

Step 1: Initial Consultation

It all begins with a chat. We take the time to understand your business, your daily drinks volume, your menu, your team’s experience, and your budget. This friendly, no-obligation conversation gives us a clear picture of what you need.

Step 2: Tailored Quote and Recommendation

With a solid understanding of your needs, we will put together a few ideal machine packages for you to consider. You'll get a crystal-clear quote that breaks down the monthly lease cost and exactly what's included. There are no hidden fees, just a straightforward proposal.

Step 3: Simple Finance Application

Once you’ve picked your machine, we make the finance application as painless as possible. We work with trusted finance partners who know commercial coffee machine leasing inside out. Our team will guide you through the simple form, and we can often get a decision within 24-48 hours.

Step 4: Installation and Barista Training

With the finance sorted, our certified engineers will schedule an installation at a time that works for you. They’ll take care of everything, from plumbing the machine in to fitting the water filter. We also provide comprehensive, on-site barista training for you and your staff to ensure you’re ready to serve brilliant coffee from day one.

Long-Term Support and Upgrades: What's Included?

One of the biggest benefits of leasing is the ongoing support. You’re not just getting equipment; you're securing a partnership that keeps your business running, protects you from surprise repair bills, and prepares you for future growth.

A good lease package is all about reliability. It’s a safety net designed to eliminate downtime and keep your coffee flowing.

Keeping Your Machine in Peak Condition

Regular, preventative maintenance is the secret to a long life for any commercial coffee machine. Our service packages take this worry completely off your plate.

This proactive approach typically includes:

- Scheduled Engineer Visits: Our experts will visit regularly to inspect, clean, and service your machine.

- Filter Changes: We manage the replacement schedule for your water filter, which is crucial for protecting the machine and ensuring great-tasting coffee.

- Performance Calibration: Our engineers make sure everything is dialled in just right for a perfect, consistent pour every time.

Rapid Response When You Need It Most

Even the best-maintained machine can have an off day. When that happens, getting it sorted quickly is what counts. We know that every minute your machine is out of action can mean lost sales.

Our rapid response process gives you a dedicated support line to call. If we can't solve the issue over the phone, we'll get a skilled engineer out to you as quickly as possible. This responsive support is at the heart of what makes leasing such a sensible choice. You can find out more about our comprehensive installation, support, and training services.

Future-Proofing Your Business with Upgrades

Perhaps the most exciting long-term benefit of leasing is how it helps you stay current. Coffee technology moves fast, and leasing means you're never left behind with outdated equipment.

As your agreement nears its end, you have the opportunity to upgrade to the latest model. It’s a chance to refresh your coffee offering and take advantage of new features without a large capital outlay.

Your Leasing Questions Answered

It’s natural for questions to pop up when you start looking into leasing a commercial coffee machine. Here are answers to some of the most common queries we hear.

Can I Lease a Refurbished Coffee Machine?

Yes, absolutely. Choosing a refurbished model is a brilliant way to get a top-tier machine from a trusted brand for a much lower monthly cost.

At ADS Coffee Supplies, we are one of the UK's leading suppliers of leases on both new and professionally refurbished machines. Before any refurbished machine is approved for lease, our in-house engineers fully strip, service, and rigorously test it to ensure it performs like new.

What Happens If My Business Needs Change During the Lease?

We understand that business is unpredictable. If you find your machine isn't keeping up anymore, the first step is to give us a call. We can often look at restructuring your agreement or arranging an early upgrade to a machine that’s a better fit for where your business is now.

Is Barista Training Included with a Lease?

Yes. When you lease a commercial coffee machine from us, full on-site barista training comes as standard. A brilliant machine is only half the story; your team needs to know how to get the best out of it. Our trainers will ensure your staff feel comfortable using the equipment and can pour a consistently fantastic cup of coffee.

What Is the Typical Lease Length in the UK?

Most commercial coffee machine leases in the UK run for either three or five years. A three-year term is a popular choice as it allows you to upgrade to the latest technology sooner. A five-year term usually means lower monthly payments, which can be great for budgeting. We can help you decide which term makes the most sense for your business.

Ready to find the perfect coffee solution for your business? The team at ADS Coffee Supplies is here to help you navigate your options and create a leasing package that works for you. Explore our commercial machine leasing options today.